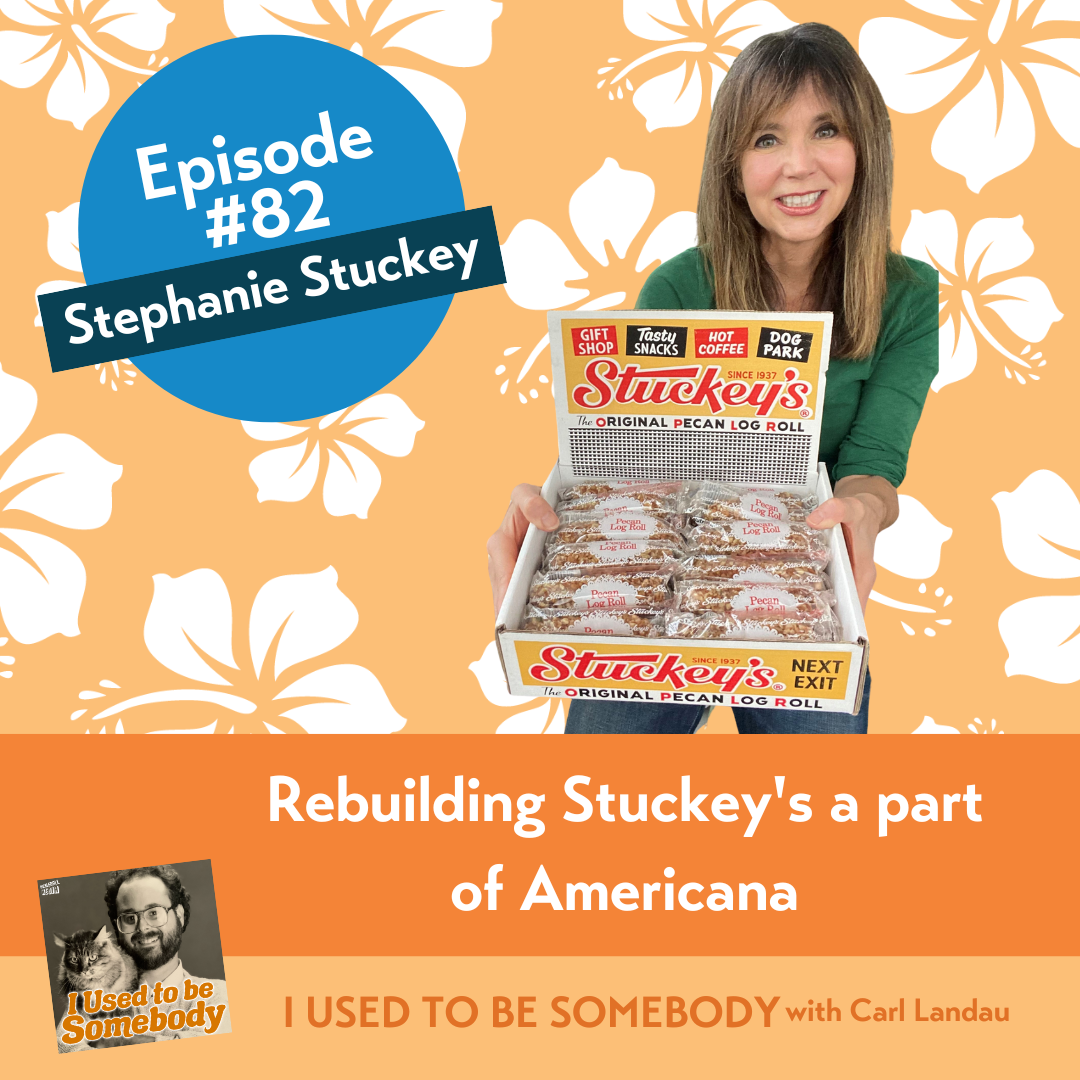

Stephanie Stuckey Interview: Rebuilding Stuckey's a part of Americana

Diana Landau | June 11, 2024

Carl interviews the unstoppable Stephanie Stuckey, the CEO of Stuckey's. The brand is known by generations as a highway oasis serving up pecan log rolls and kitschy souvenirs. Many Boomers fondly remember family road trips throughout the U.S. when stopping at Stuckey's was a tradition. Reviving her family's company is just the latest in a long list of Stephanie's accomplishments. She's been a Public Defender, a Georgia State Representative, a Director of Sustainability and Resilience for the City of Atlanta and an Adjunct Professor at the University of Georgia School of Law. Stephanie's story has recently been featured in The New York Times, the TODAY Show and the Washington Post.

Carl interviews the unstoppable Stephanie Stuckey, the CEO of Stuckey's. The brand is known by generations as a highway oasis serving up pecan log rolls and kitschy souvenirs. Many Boomers fondly remember family road trips throughout the U.S. when stopping at Stuckey's was a tradition. Reviving her family's company is just the latest in a long list of Stephanie's accomplishments. She's been a Public Defender, a Georgia State Representative, a Director of Sustainability and Resilience for the City of Atlanta and an Adjunct Professor at the University of Georgia School of Law. Stephanie's story has recently been featured in The New York Times, the TODAY Show and the Washington Post.

Stephanie was born in Easton, Georgia and was surrounded by family. "It was a fun childhood!" Her father was a U.S. Congressman, so the family split their time each year between Washington D.C. and Easton. Going back and forth between two very different homes, Stephanie says, "You grow up very resilient and you have to learn those social skills to survive."

After college and law school, Stephanie spent over 14 years as a Public Defender. She then served for 7 years as an elected Representative for the Georgia State Legislature. in 2012 she left politics and became the Executive Director of GreenLaw, an environmentally focused law resource center in Atlanta. (Another one of her passions.)

Stephanie's grandfather sold Stuckey's way back in 1964 for $16 million (the equivalent price in today's value would be $158 million). She purchased back her family's company in 2019 with no prior entrepreneurial experience. "I didn't even know how to read a balance sheet!" she tells us. Stephanie learned what she had to do--and that didn't include upgrading the actual physical stores, which were on the decline. Only a dozen out of 300+ stores were left. Instead, she realized people still wanted to be able to buy their pecan snacks and candies. Undaunted, she found two partners, (one a pecan farmer and one a marketing exec) and the brand now has an online store, a distribution center and just two years later, the company's sales have gone from $2 million to $14 million.

In addition to running the company and raising a family, Stephanie just wrote her memoir, UnStuck: Rebirth of an American Icon this year. In her spare time, Stephanie enjoys traveling by car to explore the backroads of America and pulling over at every boiled peanut stand. She says she follows her grandfather's and father's advice: Work hard, be fair and have fun!"

Stephanie's advice on starting a second (or third) act:

-

"You are not alone! I think a lot of times it's very lonely, I know it is, it can be isolating when you're trying to put something out there."

-

"Go out there and find your community so you can support each other. Just reach out!"

-

"Embrace your weaknesses as opportunities to learn and celebrate your strengths!"

• (Un)Retirement Travel with the Pro Allan Wright, Zephyr Adventures

Diana Landau is the Content Wrangler for Pickleball Media. After 15 years in corporate marketing, in 2012 she pivoted to write and wrangle content for Niche Media's weekly blog. She now manages the "I Used to be Somebody" blog.

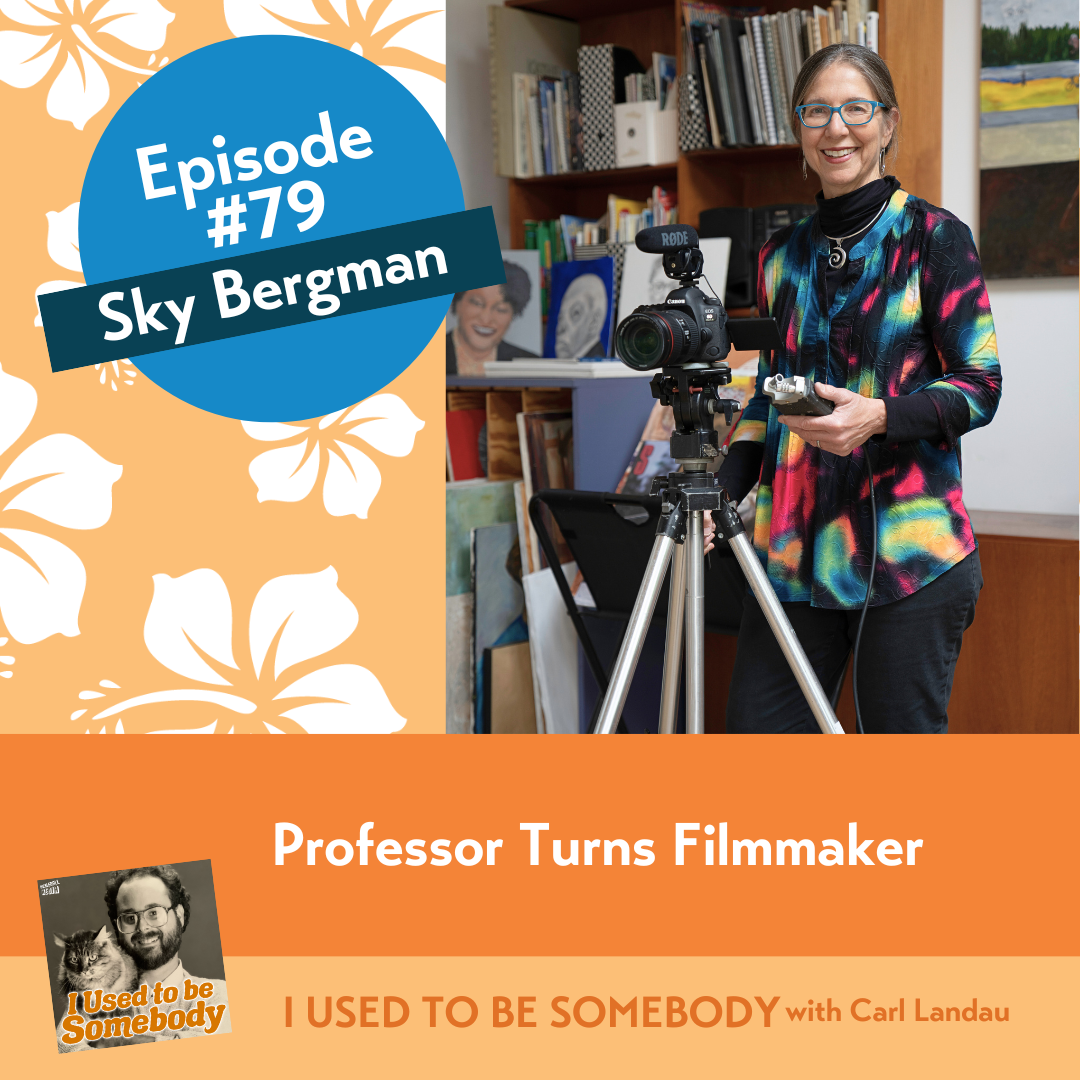

Sky Bergman Interview: Professor Turns Filmmaker

Diana Landau | February 29, 2024

Carl interviews filmmaker Sky Bergman. Sky's directorial debut, "Lives Well Lived" is currently airing on PBS, Amazon, iTunes and Kanopy. The documentary is a collection of fascinating interviews with about a dozen older adults sharing historical perspectives, their advice for future generations ad reflections on living a life well lived. Making documentaries is her second act as she is also an accomplished, award-winning photographer and still teaches photography at Cal Polytechnic State University in San Luis Obispo, CA.

Carl interviews filmmaker Sky Bergman. Sky's directorial debut, "Lives Well Lived" is currently airing on PBS, Amazon, iTunes and Kanopy. The documentary is a collection of fascinating interviews with about a dozen older adults sharing historical perspectives, their advice for future generations ad reflections on living a life well lived. Making documentaries is her second act as she is also an accomplished, award-winning photographer and still teaches photography at Cal Polytechnic State University in San Luis Obispo, CA.

Sky's parents were divorced so she grew up in Philadelphia, Florida and spent summers in upstate New York. She says she had the good fortune of living in a four-generational household. Her father was a geriatric physician. "He would come home and tell me these amazing stories about his patients. I know that colored my consciousness to want to be part of older people's lives and tell their stories."

In school, she was a bit of an introvert and a band geek. She found her passion for photography at an early age. "I fell in love with the dark room!" she says. After college she traveled the world as a professional photographer. Her artwork is included in permanent collections at the Los Angeles Museum of Art, Brooklyn Museum, Seattle Art Museum, the Bibliothèque Nationale de France, among others. Her commercial work has appeared on book covers for Random House and Farrar. She says a highlight of her photography career has been the cover of the Smithsonian Magazine in 2001. "I loved traveling and photography so I could follow both passions at the same time."

After teaching for many years, Sky (un)retired at age 56. "I wanted to make a movie about older generations and share their stories with the world." She put together a list of interesting people and a list of 20 questions for them. Carl asks her how she was able to fund the movie. "I have never let money stand in the way of what I want to do," she tells us. Sky decided the grant submission process was too lengthy for her, so she came up with a revenue-generating plan by renting out rooms in her home. She tells her visitors they are helping to fund her movie and they end up excited supporters as well. "A crazy, wonderful way to fund a film!" she acknowledges.

"Lives Well Lived" debuted to a sold-out audience of 850 with her grandmother and many of the film's subjects in attendance. It was a true highlight for Sky. She is now working on two new projects, "What is Mochitsuki?" a film celebrating family, tradition and mochi, and a documentary about the "Prime Time Band", a band of musicians aged 40 to 90 who are reigniting old passions. Sky says, "The only way to combat ageism is to make generational connections!"

Sky Bergman's (un)retirement advice:

-

"Pushing yourself beyond your comfort zone makes for a more interesting life."

-

"Develop a new sense of purpose after you retire. Who are you now and what do you still want to do? Whatever it is, you have to plan and think about your future. Remember, finding your sense of purpose is life-long, and can change over time."

-

"Have a good support system--not just family but also friends."

-

"Attitude and resilience go hand-in-hand. There are so many times in our lives when we cannot control what's happening around us. But we can control our attitude about it."

Diana Landau is the Content Wrangler for Pickleball Media. After 15 years in corporate marketing, in 2012 she pivoted to write and wrangle content for Niche Media's weekly blog. She now manages the "I Used to be Somebody" blog.

Who Am I Now? Or Weirdly, Strangely Delights You Discover in (Un)retirement

Carl Landau | February 29, 2024

It's been a few years now since I ended my full-time career and (un)retired. I have had more time for myself and everything else in general with not so many stressful demands on my time. I've noticed my perspective about some things has changed. Am I a weirdo or do you notice it in (un)retirement too?

It's been a few years now since I ended my full-time career and (un)retired. I have had more time for myself and everything else in general with not so many stressful demands on my time. I've noticed my perspective about some things has changed. Am I a weirdo or do you notice it in (un)retirement too?

In my full-time career, I felt like my schedule was always at warp speed, even bringing my laptop on vacation. (Ok, I still do that.) But I'm actually enjoying becoming sort of "Zen-like" about very ordinary things that I either hated to do or rushed through to do.

I'm a different guy now! Here's what I mean:

Trash/Recycle Guy: Once a week, we need to put out the trash can at the curb and every-other-week the recycling. I find that now I'm somehow in some sort of a contest with my next- door neighbor, Norman, who can get the cans out faster than anyone on the street. (Full exposure, I'm sure my neighbor has no idea about this supposed contest.) And when I take a walk around the neighborhood now, I'm even picking up the knocked over empty trash cans that are laying in the street. I'm this guy now?

Laundry/Football Guy: I hate doing laundry. Yet somehow I'm now looking forward to doing laundry and folding clothes while I watch football/basketball/baseball. (Did you know there is actually only 18 minutes of live action during a typical NFL game?) My wife appreciates this new laundry guy very much.

Stretch/Meditate Guy: I am an A-personality type guy that never allowed down time for anything. Now I find myself every morning spending at least 15-20 minutes of mindful stretching on a yoga mat and meditating to some music. My 17-year old cat, Felix, joins in on the yoga-mat-fun and "stretches" with me. He thinks this is his new daily routine too. (Imagine him waving his tale in my face, jumping over me and generally bothering me to the beat of the tunes.) So even the cat likes this guy.

Breakfast Tea Guy: I drank glasses of Diet Coke every morning for 45 years. A month ago, I decided to stop. I feel so much better now! I really can't believe the difference. Since I don't care for coffee, I am now a cup or two, tea-drinker with honey and a little-spoon to go with it. Yep, that's me now. I start the day relaxed and calm, vs. hyped up on diet coke. Everyone likes this guy.

Feelings Guy: I don't end any phone call or visit with my daughters without saying "I love you so much." I'm telling my college friend and roommate from 45 years ago that I love him. What in the hell is happening to me? But I think I like this empathetic, Kumbaya guy.

I sure hope this continues. I wonder what changes will happen next. What about you?

My 6 Best (Un)Retirement Decisions

Carl Landau | February 10, 2024

I'm currently starting my 4th year of what we call (Un)Retirement. And maybe I've learned a thing or two I can share to help you...

I'm currently starting my 4th year of what we call (Un)Retirement. And maybe I've learned a thing or two I can share to help you...

Actually do it and retire! I thought about it many times. Exactly when should I cut the cord and stop working the crazy hours and dealing with the pressure of running my own business for 40+ years? The best advice I give people about (Un)Retirement is do it sooner rather than later. I wish I had sold/quit 5 years earlier. The last couple of work years were a drag on my mind, body and spirit. And I didn't realize it until I stopped.

Hire a pro to create a financial plan. The reason I felt comfortable in stopping the job/career is that I had been working with a great financial planner for several years in anticipation of the change. That person is Ian Castille at Capital Advantage and I consider him a good friend at this point.

I talk to so many people that have/had successful careers and have created wealth that they manage themselves. Or at least they try. This is crazy. What do you truly know about the financial market? I'd rather pay someone that studies the market all day to make my decisions. I sleep so much better at night because of this.

Avoid the temptation to go back! You are an expert with experience and it's so tempting to go back. I was in the live event biz for the past 20 years. I know that business back and forth and have seen so many opportunities to return. But, every time I return to my senses (also with the wise counsel of my wife Diana who had to put up with my totally-consumed-working-self for many years). Now I focus on where I'm going!

Do something new. Use the skills you already have, except in a new way. After working for decades, we all have developed incredible insights into organization, management, writing or whatever. Just use that toolbox in some new and cool endeavor.

Hire someone to do the shit you don't like to do or aren't good at. When I first was launching our podcast and newsletter I was going to hire an assistant. But my friend Bekah said I should consider hiring a virtual assistant company. I did that 3+ years ago. I hired a company Monkey Creative. It was one of the best decisions I ever made. No employees for me to worry about and I only pay for what I need done. I get to do the writing and they handle the graphics, e-marketing and all the other stuff I don't want to do/not good at.

Just start and see what happens. I didn't have a plan beyond starting the I Used to be Somebody podcast and newsletter. Then I took a leap of faith. Perhaps it would lead to something else? It lead to me interviewing 80 incredible people that I would never have met in a million years. Many I now consider my friends. The podcast and some pickleball talk led to Diana and I co-authoring (with our instructor and friends Mo and Reine) the Amazon best-seller, Pickleball for dummies. Most recently, my new path has led to leading vacation tours around the world for our podcast audience. You never know...

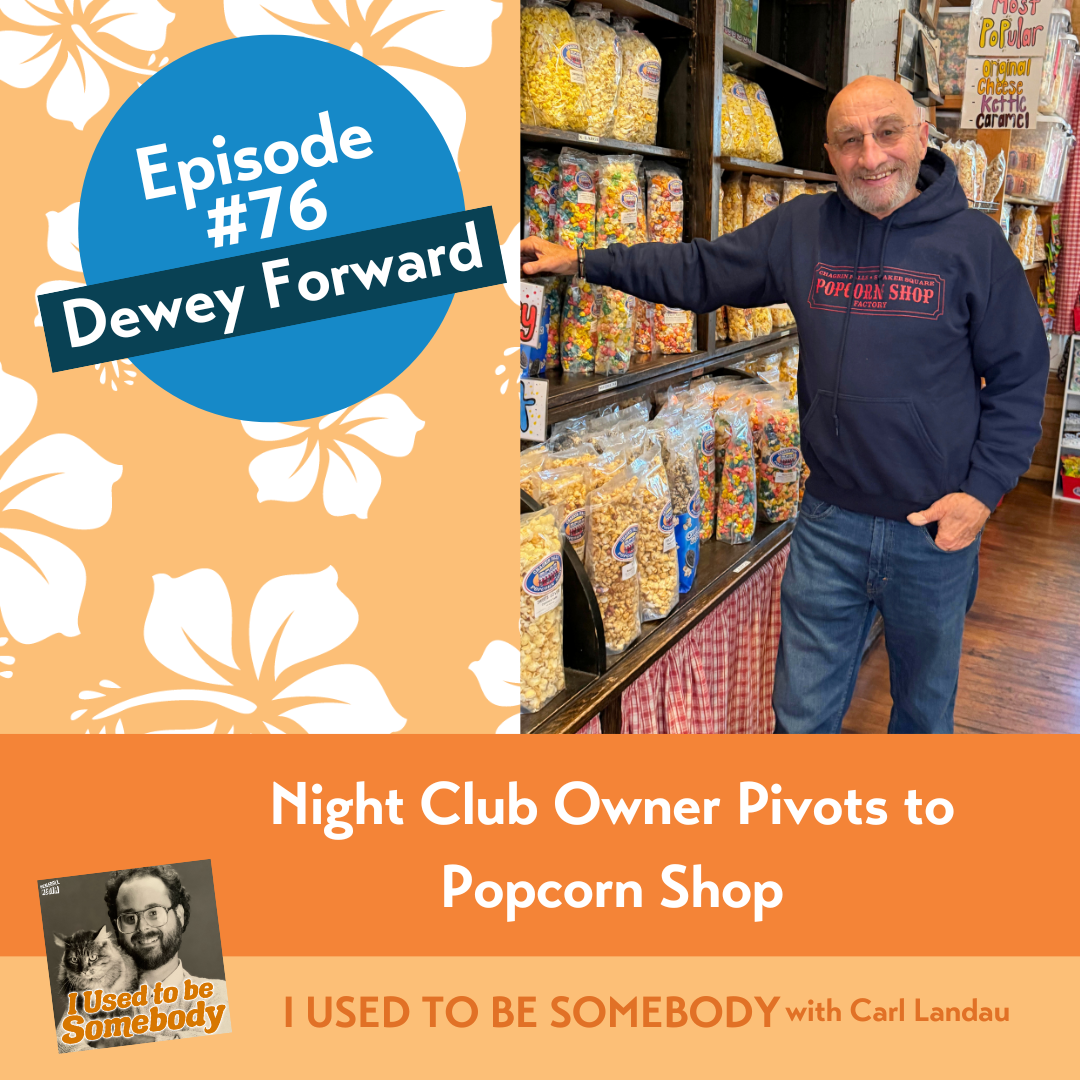

Dewey Forward Interview: Night Club Owner Pivots to Popcorn Shop

Diana Landau | December 04, 2023

Carl interviews music promoter/serial entrepreneur Dewey Forward this week. Just some of Dewey's accomplishments include organizing and promoting over 4,000 concerts, opening Peabody's Cafe and Peabody's DownUnder in Cleveland Flats and also developing the Sohio/BP RiverFest, (which was Ohio's largest festival in history with over 1,000,000 attendees). He has produced concerts for Spyro Gyra, Pearl Jam, Etta James, Wynton Marsalis, REM, Donovan, Bon Jovi, Bo Diddley and countless others. Dewey is also now the proud owner of an iconic popcorn shop in picturesque Chagrin Falls, OH.

Carl interviews music promoter/serial entrepreneur Dewey Forward this week. Just some of Dewey's accomplishments include organizing and promoting over 4,000 concerts, opening Peabody's Cafe and Peabody's DownUnder in Cleveland Flats and also developing the Sohio/BP RiverFest, (which was Ohio's largest festival in history with over 1,000,000 attendees). He has produced concerts for Spyro Gyra, Pearl Jam, Etta James, Wynton Marsalis, REM, Donovan, Bon Jovi, Bo Diddley and countless others. Dewey is also now the proud owner of an iconic popcorn shop in picturesque Chagrin Falls, OH.

Like Carl, Dewey grew up in Shaker Heights, a suburb of Cleveland. "It was a 'Leave it to Beaver' childhood, " he says. Enterprising even at the age of 9, Dewey started a "canteen" in his basement, selling refreshments and a place to hang out to the neighborhood kids. He also says he was a troublemaker in school and was on a first name-basis with the Principal.

After trying out three colleges, Dewey settled on Hartford where he says he didn't learn much in class but learned a lot about producing successful events. "I learned how to organize and promote concerts and events and how to create a crowd." He founded SAW--a student organization against the Vietnam War, organizing bus trips to Washington D.C. to protest.

Fun Fact: Dewey Forward is a "Jr.", his last name of English descent. "No one forgets my name!"

Carl notes that being a concert and event producer is a high-stress, high-risk career. "Yes, my parents were aghast but I didn't listen to them." In 1977 Dewey opened Peabody's Cafe and Peabody's DownUnder, two successful ventures in the up-and-coming Cleveland Flats neighborhood. His mother gave him the money to start both businesses. "I paid her back and I'll forever be grateful." By the time Dewey moved on, the area had grown from 5 restaurants and bars to 53. "When I look back on it, it was a blast but also so stressful."

Dewey retired for the first(!) time at age 50. Not one to sit still, he started a new business every five years. Now at 74, he's learning not to add more stress into his life. He does a lot of physical activity, including bike riding. "It clears my head and is good for my heart!" He and his girlfriend love to travel and he's building a second home on Lake Erie. His five words for the (un)retirement good life: "Keep moving and no stress!"

Dewey Forward's (un)retirement tips:

-

"Get rid of that negative voice in your head that tells you that you can't do things. We are a very capable generation!"

-

"Don't be too old to retire. What I mean is, do not keep working until your body is too old to do anything else."

-

"I'm not a planner. I just say, 'That looks fun!' and then I put blinders on and go for it!"

Diana Landau is the Content Wrangler for Pickleball Media. After 15 years in corporate marketing, in 2012 she pivoted to write and wrangle content for Niche Media's weekly blog. She now manages the "I Used to be Somebody" blog.

Carl interviews the unstoppable Stephanie Stuckey, the CEO of Stuckey's. The brand is known by generations as a highway oasis serving up pecan log rolls and kitschy souvenirs. Many Boomers fondly remember family road trips throughout the U.S. when stopping at Stuckey's was a tradition. Reviving her family's company is just the latest in a long list of Stephanie's accomplishments. She's been a Public Defender, a Georgia State Representative, a Director of Sustainability and Resilience for the City of Atlanta and an Adjunct Professor at the University of Georgia School of Law. Stephanie's story has recently been featured in The New York Times, the TODAY Show and the Washington Post.

Carl interviews the unstoppable Stephanie Stuckey, the CEO of Stuckey's. The brand is known by generations as a highway oasis serving up pecan log rolls and kitschy souvenirs. Many Boomers fondly remember family road trips throughout the U.S. when stopping at Stuckey's was a tradition. Reviving her family's company is just the latest in a long list of Stephanie's accomplishments. She's been a Public Defender, a Georgia State Representative, a Director of Sustainability and Resilience for the City of Atlanta and an Adjunct Professor at the University of Georgia School of Law. Stephanie's story has recently been featured in The New York Times, the TODAY Show and the Washington Post.

Carl interviews filmmaker Sky Bergman. Sky's directorial debut, "Lives Well Lived" is currently airing on PBS, Amazon, iTunes and Kanopy. The documentary is a collection of fascinating interviews with about a dozen older adults sharing historical perspectives, their advice for future generations ad reflections on living a life well lived. Making documentaries is her second act as she is also an accomplished, award-winning photographer and still teaches photography at Cal Polytechnic State University in San Luis Obispo, CA.

Carl interviews filmmaker Sky Bergman. Sky's directorial debut, "Lives Well Lived" is currently airing on PBS, Amazon, iTunes and Kanopy. The documentary is a collection of fascinating interviews with about a dozen older adults sharing historical perspectives, their advice for future generations ad reflections on living a life well lived. Making documentaries is her second act as she is also an accomplished, award-winning photographer and still teaches photography at Cal Polytechnic State University in San Luis Obispo, CA.

It's been a few years now since I ended my full-time career and (un)retired. I have had more time for myself and everything else in general with not so many stressful demands on my time. I've noticed my perspective about some things has changed. Am I a weirdo or do you notice it in (un)retirement too?

It's been a few years now since I ended my full-time career and (un)retired. I have had more time for myself and everything else in general with not so many stressful demands on my time. I've noticed my perspective about some things has changed. Am I a weirdo or do you notice it in (un)retirement too? I'm currently starting my 4th year of what we call (Un)Retirement. And maybe I've learned a thing or two I can share to help you...

I'm currently starting my 4th year of what we call (Un)Retirement. And maybe I've learned a thing or two I can share to help you... Carl interviews music promoter/serial entrepreneur Dewey Forward this week. Just some of Dewey's accomplishments include organizing and promoting over 4,000 concerts, opening Peabody's Cafe and Peabody's DownUnder in Cleveland Flats and also developing the Sohio/BP RiverFest, (which was Ohio's largest festival in history with over 1,000,000 attendees). He has produced concerts for Spyro Gyra, Pearl Jam, Etta James, Wynton Marsalis, REM, Donovan, Bon Jovi, Bo Diddley and countless others. Dewey is also now the proud owner of an iconic popcorn shop in picturesque Chagrin Falls, OH.

Carl interviews music promoter/serial entrepreneur Dewey Forward this week. Just some of Dewey's accomplishments include organizing and promoting over 4,000 concerts, opening Peabody's Cafe and Peabody's DownUnder in Cleveland Flats and also developing the Sohio/BP RiverFest, (which was Ohio's largest festival in history with over 1,000,000 attendees). He has produced concerts for Spyro Gyra, Pearl Jam, Etta James, Wynton Marsalis, REM, Donovan, Bon Jovi, Bo Diddley and countless others. Dewey is also now the proud owner of an iconic popcorn shop in picturesque Chagrin Falls, OH.